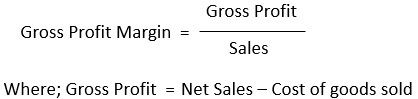

Any cost pertaining to audits, registration, and transfers, legal checks, etc., are also a part of the expense ratio. Legal/Audit fee – Mutual funds are governed by the Securities and Exchange Board of India, and hence, complying with all the regulations and laws, they need constant legal intervention and audits of their processes, schemes, etc.For passively managed funds, this component of the mutual fund expense ratio is far lower than actively managed, because the fund manager need not actively manage the fund’s portfolio in the former. Such actively managed mutual funds’ expense ratio includes the compensation to the fund manager as a part of the expense ratio. Fund Manager’s fee – Every mutual fund comes with an investment objective and it is the fund manager’s decisions that ensure that these objectives are met.There can be multiple types of expenses associated with a mutual fund expense ratio, like. You can find the expense ratio for your mutual fund scheme on ET Money. And irrespective of whether the returns are positive or negative, this expense ratio must be paid until you stay invested. Each day, a portion of your corpus is being paid to the fund house as the expense ratio, thereby reducing the returns. You pay Rs 3.44 on 1st Jan, Rs 3.42 on 3rd Mar, and so on. If your investment in this fund is Rs 1,00,000, and assuming your investment value grows to Rs 1,00,500 and 1,00,125 on two subsequent days, this is how much expense ratio you pay on each day. Let us understand the expense ratio meaning with an expense ratio example, assuming your mutual fund scheme’s expense ratio is 1.25%. This implies that in a year, each investor will have to pay 2% as the expense ratio to the AMC, which will be deducted each day till the time you are invested in the scheme. Hence, the expense ratio formula will be= Rs 14 Cr/Rs 700 Cr= 2% Now that you have understood what is mutual fund expense ratio let us assume a hypothetical equity mutual fund scheme with AUM (assets under management) of Rs 700 Cr, and the expenses it bears for the above said costs sum up to Rs 14 Cr. Total costs that are borne by the fund= The costs incurred by the AMC mentioned above like fund manager’s fee, marketing, and distribution expenses, legal/audit costsĪverage assets under management= The total value of all investors’ money in that fund 3. The formula for Expense RatioĮxpense Ratio= (Total costs that are borne by the mutual fund)/(Average assets under management) Hence, a mutual fund scheme with a lower expense ratio is more beneficial to you because it takes away a lesser portion of money from your returns. But this deduction of the expense ratio is lowering your returns by a tiny amount every day.

The per-day levying of the expense ratio ensures that you only pay for the period you stay invested. You do not pay for this expense ratio separately it is calculated as a percentage of the daily investment value.įor example, if you invest Rs 5000 in a mutual fund with an expense ratio of 2%, then (2%/365=0.0054%) will be deducted from the investment value each day. The expense ratio differs from one mutual fund to another. In other words, it is the per-unit cost for running and managing the mutual fund. The expense ratio is the percentage that denotes the amount of money you are paying to the AMC as a fee to manage your investments.

This cost is passed on to the investors as a percentage of your investment value and is called the mutual fund expense ratio. There is a lot of behind-the-scenes work of management of the fund and its operating expenses, which comes at a cost. The Asset Management Companies (AMC) or Fund Houses offer different kinds of mutual funds to us, and an expert manages each fund. Any product or service you buy/avail of comes with a price tag.

0 kommentar(er)

0 kommentar(er)